Ranking Member Scott, Aging Committee Members Hold Hearing on Financial Literacy

WASHINGTON – Today, U.S. Senate Special Committee on Aging Ranking Member Tim Scott (R-S.C.), along with Chairman Bob Casey (D-Pa.), held a hearing titled "Financial Literacy: Addressing the Unique Just-in-Time Decisions Older Americans and People with Disabilities Face." Throughout the hearing, Aging Committee members and witnesses shed light on the importance of financial literacy for older Americans and people with disabilities, particularly when it comes to combatting financial fraud and potential scams.

Click to watch the hearing, including Ranking Member Scott’s opening remarks

On why he champions financial literacy … “As a kid who was raised in a single-parent household mired in poverty, but blessed with a loving mother, I understand and appreciate the importance of learning financial principles as early in life as possible. It is one of the reasons why I co-chair the financial literacy caucus along with Senator Jack Reed. Since 2015, we have declared April as Financial Literacy Month through a resolution in a bipartisan fashion. …

“It is never too late to learn the importance of financial literacy. [Part] of my focus [is] making sure that every American — and particularly our senior Americans – have an opportunity to understand and appreciate and to benefit from financial literacy.”

On financial literacy and inclusion … “To have financial literacy, we must have financial inclusion. That is why it’s so important to continue to work in many ways to advance the cause of equal access to opportunity throughout our country.

“Building on financial inclusion, I have also introduced — along with Senator Joe Manchin — the Credit Access and Inclusion Act of 2021, to expand access to credit for an estimated 45 million Americans with no credit history. When you pay your bills on time, it should help improve your credit. It’s kind of that simple.”

Click here to read Ranking Member Scott's opening statement.

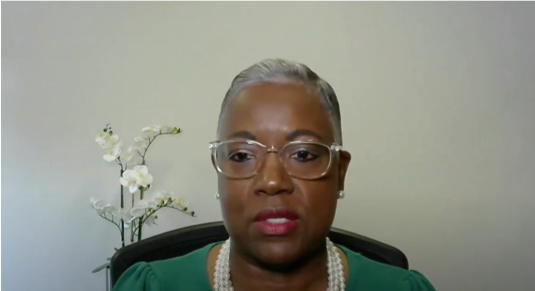

Speaking on the witness panel was Dorothea Bernique, the founder and executive director of Increasing H.O.P.E, an organization that seeks to help South Carolinians improve their financial literacy.

Click to watch Ms. Bernique’s testimony

On why she started Increasing H.O.P.E. … “When I started my career several years ago as a financial representative, I thought this was the way that I was supposed to help individuals in the community learn how to manage their money. Little did I know that the need was so much greater than I’d ever imagined. And I was clearly made aware of it on the day that I decided to leave my job.

“On this day, a client came in [and] talked about making an investment. She had called to set up an appointment and was driven by her daughter to our appointment. Part way through our conversation, she leaned in a little closer to me and she whispered, ‘Ms. Dorothea, what’s investing?’ That was the day that I gave myself a pink slip and decided to walk away from a career to start Increasing H.O.P.E.”

On the meaning of financial well-being … “Financial well-being is defined as an individual who has the ability to control their day-to-day and month-to-month finances. They have the capacity to absorb financial shock. They can stay on track with their financial goals. And finally, they have the ability to make financial choices so they can enjoy life.”

On the impact of financial literacy … “By teaching individuals how to manage their money so that they can manage their lives, we get to change lives. … The lack of financial literacy, coupled with low financial well-being and the impact of COVID on families may seem over whelming. However, there is still hope. And Increasing H.O.P.E. Financial Training Center will continue to make a difference in our community one class at a time, one counseling session at time, and one person at a time.”

Click here to read her written testimony.

###

.png)